Lee County’s appraised property values have increased more than 6% in the past year. According to data released on Tuesday by the Lee County Property Appraiser. However, the total property value in the county is still about $10 billion less than agriculture. What real estate was worth ten years ago, just before the Great Recession.

Lee County’s appraised property values have increased more than 6% in the past year. According to data released on Tuesday by the Lee County Property Appraiser. However, the total property value in the county is still about $10 billion less than agriculture. What real estate was worth ten years ago, just before the Great Recession.

Or

Want information about real estate in Lee County? If the answer is yes, that means you reach the exact location. Here, you’ll get most of your problems solved. But, If you’re not satisfied and doubt your mind then feel free to contact Lee County customer service.

Visit the Lee County Property Appraiser Website

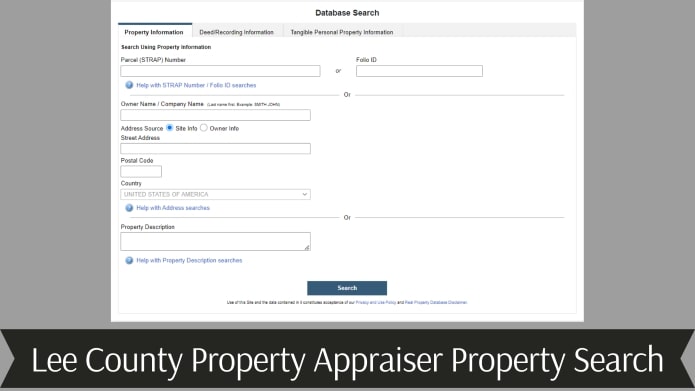

In the meantime, for a more detailed search of your property with Lee County Property Appraiser Search. It would be a good idea to visit the Lee County Property Appraiser, but it would be even better to read the article. By using the website, you can find out how much your property is worth. Discover other properties for sale and check the value of your property on this site.

Discover other properties for sale and check the value of your property on this site.

Fill out the Cape Coral Property Appraiser form

Fill out the Lee County Property Appraiser form that appears on the Lee County Property Appraiser page at www.leepa.org. A Lee County Property Appraiser Search can be performed using the following information. Such as owner name, location address, property ID, and neighborhood code. You can now click the “Search” button once you have entered all the necessary information.

Choose what to do with the Lee County Property Appraiser search result.

The search result contains a variety of information, including but not limited to owner name, lot ID, property ID, and of course value. You have the option to share, print, or download the content from the Lee County Property Appraiser website (www.leepa.org).

The GeoView Application of Lee County Property Appraiser

GeoView’s tools and data can be accessed by clicking the icons in the four corners of your browser window. These icons toggle the menus on and off. To quickly select lots, zoom in on the lots as far as you can see them and right-click (press and hold) the lots you want to select. Toolbox tools – The icon in the upper left corner opens the Map Tools menu. In this Lee County Property Appraiser menu, you will find icons that allow you to click to zoom and pan, search lots, measure distances and areas, add and highlight your text, save your map as an image, print the visualization, and much more to display a map visualization.

Toolbox tools – The icon in the upper left corner opens the Map Tools menu. In this Lee County Property Appraiser menu, you will find icons that allow you to click to zoom and pan, search lots, measure distances and areas, add and highlight your text, save your map as an image, print the visualization, and much more to display a map visualization.

Lee County Property Appraiser Homestead Exemption

The Homestead Waiver for Lee County Property Appraiser is a constitutional benefit of up to a $50,000 waiver that is deducted from the appraised value of your property. It will be awarded to applicants who own Lee County Florida Property Appraiser and are bona fide Florida residents who live in the home and make it their permanent residence on January 1. Lee County FL Property Records documents are required to show that you used to live on the property for Lee County Property Appraiser Search.

Lee County Property Appraiser homeowners who benefit from the homeownership exemption should be aware. Because, renting their property, either personally or through shared consumption or collaborative businesses, can constitute abandonment and, consequently, a loss of Lee County FL Property Records. Rent generally means exclusive use by a tenant on a temporary, seasonal, or annual basis. If you want to rent, consult with the appropriate attorney to ensure that you do not jeopardize your property exemption. If you waive the property tax exemption, your property taxes will increase.

Agricultural Classification

The Lee County Property Appraiser may, before classifying such land, require the taxpayer, or Its representative to provide information reasonably necessary to demonstrate that such land is used for genuine agricultural purposes.

The Lee County Appraiser real estate expert may refuse agricultural suitability for the following areas:

The Lee County Appraiser real estate expert may refuse agricultural suitability for the following areas:

- Land not used or diverted from agricultural use

- It’s designated as non-agricultural at the request of the owner

- Land on which a plot is registered

- Purchased at a price three or more times the agricultural value of the land

Tangible Property Taxes

- If you operate a business or rent out your Lee County Appraiser, you are subject to value-added tax.

- The tax on movable tangible Lee County Property Appraiser property is an ad valorem tax based on the following categories of Lee County FL Property Records property.

- Business: Furniture, utensils, signs, supplies, and equipment used in the operation of the business.

- Rental Furniture: Furniture and equipment provided in a rental unit.

- Florida law 193,052 requires anyone who owns Cape Coral Property Appraiser property on January 1st to file a Property Tax Return (DR-405) with the real estate appraiser by April 1st of each year.

- Failure to submit or late delivery of a declaration will result in a fine and additional costs.

Exemptions are Available to Those Who Qualify?

Those whose names appear on the Lee County Property Appraiser deed. Also, Those who reside on the property on January 1 and are bona fide Florida residents as of January 1 can apply. The temporary or seasonal rental of a homestead may be considered a waiver of the homestead exemption. Contact the Lee County FL Property Appraiser office for more information.

In case of Lee County FL Property Records-related questions, please contact the Lee County Property Appraiser office for more information. You may be entitled to exceptions other than those listed below:

Senior Exemption- All Lee County residents aged 65 or older as of January 1 and whose adjusted annual gross household income does not exceed the mandatory income threshold are eligible. Income ceilings are adjusted annually (guidelines for seniors and downloadable forms). This Lee County Property Appraiser’s current income limit and more information about the Consumer Price Index (CPI) can be obtained from the Secretary of Finance.

$500 Widow/Widower’s Exemption- To claim the widower’s exemption, you must be a widower and certify your spouse’s death before January 1 of the tax year. Divorced persons are not entitled to this exemption.

$500 Disability Exemption – Lee County Florida Property Appraiser residents who provide proof of complete and permanent disability or proof of legal blindness may qualify. A medical certificate from Lee County Property Appraiser or a statement from the Department of Services for the Blind is required. No income criteria are needed. (Florida Medical Disability Certification forms are available at the office or on the website.)

| Site Name | Lee County Property Appraiser |

|---|---|

| Use | Property Search |

| Type | Portal |

| Country | USA |

| Language | English |

More Information About Exemptions

Introduction To The Exemption For Surviving Spouses Of Firefighters Killed In The Line Of Duty – All Lee County Property Appraiser property belonging to the surviving spouse of a first responder who was killed in the line of duty while employed by the state or any political subdivision of the state, including special agencies and districts, and for which there is a letter from the state or the appropriate Lee County FL Property Appraiser.

Veteran $5,000 Disability Exemption – Discharged ex-military rated as having a 10% to 99% disability due to war or service-related adversity may be eligible for Lee County Property Appraiser. The veteran’s surviving spouse may also qualify for this exemption. (Provide VA documentation showing the percentage of a service-related injury.)

Exemption For Veterans With Total And Permanent Disabilities – Veterans who have been honorably discharged and have a complete and permanent service-related disability may be eligible for a full Lee County FL Property Appraiser ad valorem tax exemption. (Provide VA documentation showing complete and permanent disability.)

Veteran Exemptions – Additional Waivers for Qualified Veterans 65+ and Qualified Seconded Military Personnel; For more information, don’t hesitate to get in touch with www.leepa.org.

Exemption From Ad Valorem Taxation Of Homestead Property – Lee County Property Appraiser’s section 196.101, F.S. states that goods belonging to paraplegics are tax-exempt; There is no income limit for Lee County Property Appraiser. Persons who are paraplegic, hemiplegic, or with a total and permanent disability. Those who must use a wheelchair to get around, or who are legally blind and provide certification, are exempt from ad valorem tax.

- An income ceiling applies

- Proof of gross income and/or another government-issued severely disabled ID card is required. (Florida Medical Disability Certification forms are available at the office or can be downloaded from the website.)

About Lee County

There is a rapid growth rate in Lee County, which is located south of Atlanta. In 2005, this county was ranked as the 46th fastest-growing county in the United States. This Lee County Property Appraiser has a total area of 355 square miles or 227,200 acres. Today, the population of Lee County Appraiser is estimated at 31,000 and growing to 3.5 people a day. Housing construction adds 8 to 10 new homes a week. In 2005, the total number of vehicles tagged was 31,711, compared to 30,674 in 2004.

Now let’s find out something about Lee County Property Appraiser. It was one of the first tracts of land acquired by treaty from the Creek Indians in 1825. The 68th County of Georgia was named after Richard Henry “Lighthouse Harry” Lee, father of Confederate General Robert E. Lee. In 1779, Lighthouse Harry paid tribute to George Washington. Starkville was the original county seat but was later moved to what is now the county seat at Cape Coral Property Appraiser of Leesburg in 1876. Following the completion of the Americus to Albany railroad in 1857.

Frequently Asked Questions

How Do I View My Trim Notice for Cape Coral Property Appraiser?

To view your clipping note, go to the Cape Coral Property Appraiser search page. If you haven’t already, please read the Lee County Property Appraiser Database Disclaimer and accept the terms to continue. As soon as you accept the terms of the Lee County Property Appraiser, you will be redirected to the Lee County Florida Property Appraiser search page. Here you can search for a package by STRAP, owner name, or address; Click the search button to display a list of possible matches to your Lee County Appraiser criteria.

What Causes Lee County Property Appraiser Values To Vary Year To Year?

Of course, if the Lee County Property Appraiser market value changes, the estimated (fair) value will also change. For example, if you were to increase the total market value of your property. By building a swimming pool in your backyard, the appraised value would increase accordingly.

If your property’s value decreases due to a fire or storm. Then the Lee County Property Appraiser value will decrease accordingly to reflect the negative impact on your property’s market value. In addition, community-wide economics and forces of supply and demand affect the appraisal value of your property.

What Is Tangible Personal Property?

Tangible personal property is any property used in a commercial or rental activity subject to an ad valorem valuation at Lee County Property Appraiser. More specifically, they are furniture, utensils, tools, machines, equipment, equipment, signs, improvements, materials, and equipment for rent, everything that is used to generate income.

Conclusion

Let’s say you have questions about your Lee County Property Appraiser value or allowable exemption and other information related to Lee County Property Appraiser. In this case, you can contact the real estate specialist at www.leepa.org or call 239.533.6100.